The global market for hot-rolled coil was under pressure in 2025

Regulatory changes were a key factor in the European market

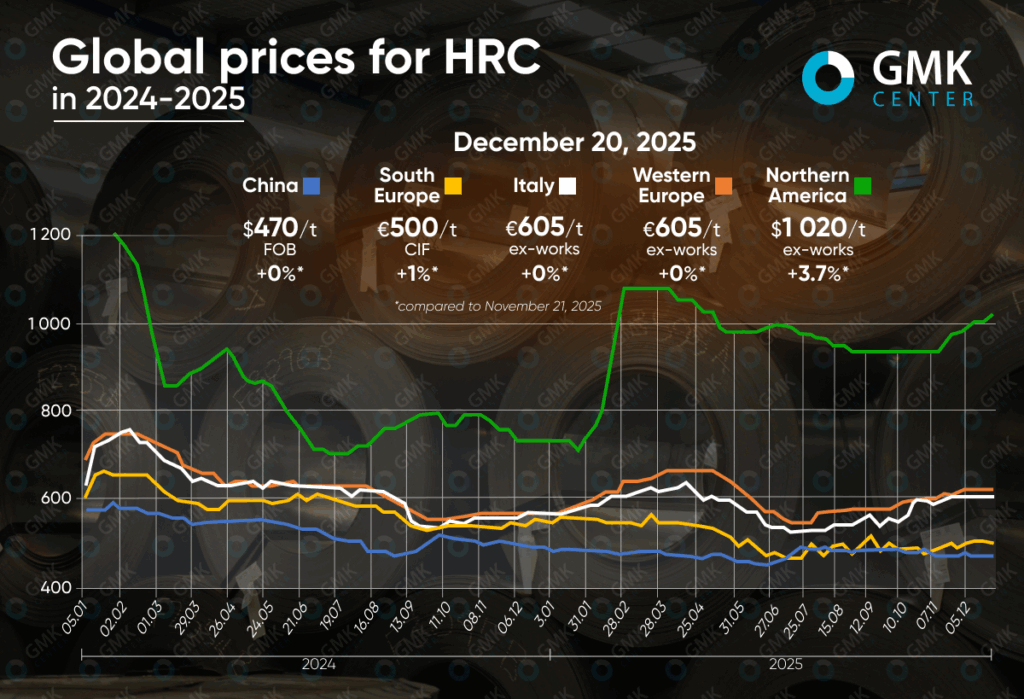

The global market for hot-rolled coil experienced moderate pressure in 2025. Despite an upward trend at the end of the year, average annual prices for products fell by 5-12%. The exception is the US, where the indicator rose by an average of 11.1% over the year.

Europe

In the EU market, average annual prices for hot-rolled coil (HRC) declined in most key regions. In Western Europe, the indicator fell by 4.6% compared to 2024, amounting to €603.2/t Ex works. As of mid-December, offers in the region are €620/t Ex works, which is 9.3% more than in December 2024 and 1.6% more than in the previous month. This level has been maintained since the beginning of the month and is the highest since the beginning of June.

In Italy, the average annual figure for 2025 is €578.4/t Ex works, which is 7% less than in 2024. Currently, prices in mid-December are fixed at €605/t Ex works, which is 7.1% more than in December last year.

The market for imported hot-rolled steel in Southern Europe has experienced a significant decline, averaging €512.7/t CIF for the current year, which corresponds to a 12.1% year-on-year decrease. Current offers are €500/t CIF, which is 9.1% less than in December last year, but 1% more than a month earlier.

In the last months of the year, the European hot-rolled coil market gradually stabilized after a long period of weak demand. The key driver of change was not increased consumption, but regulatory factors. Producers were able to keep prices above the psychological mark of €600/t, but growth was slow and uneven, with frequent discounts to fill volumes during periods of low activity. Buyers remained cautious, working in small batches amid significant import stocks contracted in the summer.

Uncertainty surrounding CBAM and the future regime of protective measures had a decisive impact on the market. Imports, although still attractive in terms of price, lost competitiveness due to the risks of additional costs, customs clearance delays, and the complexity of calculating carbon payments. This gradually shifted the balance in favor of domestic producers, who were increasingly defending their prices. Additional support for the market came from limited supply of certain steel grades, longer delivery times, and the reluctance of mills to quickly restart blast furnace capacity due to high costs and a shortage of CO2 quotas. Even ArcelorMittal’s latest price increase at the end of the year had a rather symbolic effect, highlighting the impact of regulations on the market.

HRC prices in the EU are expected to remain elevated and volatile in 2026. The full launch of CBAM and the new trade defense regime in the middle of the year will support prices, but weak recovery in industrial demand may limit growth potential and shift the main pressure to consumers in the second half of the year.

USA

The US hot-rolled coil market entered a phase of steady upward trend this year, in sharp contrast to the situation in other regions, with average annual prices rising by 11.1% to $949.4/t Ex works. Offers are currently at around $1020/t Ex works, up 39.1% compared to December 2024 and 3.7% over the last month. Offers have also reached their highest level since May.

The key factor behind the growth was the consistent pricing initiatives of domestic producers, primarily Nucor, which raised spot prices every week since the end of October. This gradually pushed up market prices, even amid subdued sales volumes and a seasonal slowdown in activity at the end of the year. The market was also supported by strategic capacity shutdowns in the second half of the year, lower inventories at service centers, and reduced import pressure, which was limited by both trade policy and demand structure.

At the same time, the rise in prices did not occur against the backdrop of a sharp increase in consumption. Demand remained selective. Galvanized and cold-rolled products were purchased more actively, while HRC moved more slowly. Some market participants viewed the price increases as an attempt by mills to set the tone for 2026, capitalizing on positive expectations for infrastructure projects, data centers, the semiconductor industry, etc. At the same time, the return of mills to higher utilization rates limited the potential for sharp jumps.

Relatively high HRC prices are expected to persist in the US in 2026. The market will be supported by infrastructure investments, demand from pipe manufacturers, and more stable macroeconomic expectations. At the same time, excess capacity and dependence on real growth in end consumption may limit the pace of further price increases.

China

In China, average annual HRC prices in 2025 amounted to $477/t FOB compared to $528.7/t FOB in 2024 (-9.8% y-o-y). Currently, market offers are at $470/t FOB, which is 4.1% less than in December last year and corresponds to the previous month’s figure.

At the end of the year, the Chinese HRC market is moving in a mode where futures are stronger than the spot segment. Exchange quotations reacted to news of possible supply restrictions, including rumors of production controls in Tangshan and the expansion of repair campaigns due to air pollution, as well as fluctuations in commodity markets. Rising iron ore prices and unstable coking coal dynamics supported futures in the short term. At the same time, the spot market remained sluggish as apparent consumption declined and buyers were unwilling to accept increases, resulting in limited or declining dynamics. Despite a gradual reduction in inventories, traders often used price concessions to accelerate shipments.

The export segment deteriorated amid weak demand in key regions and fierce price competition, including VAT-free export offers. Attempts to raise prices in line with futures were met with caution from importers and deals close to cost.

In 2026, the introduction of new export declaration and licensing rules on January 1 will be a key factor. Uncertainty about the new rules may limit exports without VAT refunds, reducing supply in foreign markets and supporting prices. At the same time, weak domestic demand and high competition for export markets will keep pressure on prices and increased volatility throughout the year.