ExclusiveSteel consumption in Romania: a test of strength

Demand for steel in Romania will face serious challenges in 2026

Romania has low per capita steel consumption compared to the industrially developed countries of the European Union. This indicates significant potential for the local market, which has been stagnant in recent years.

Even post-COVID government economic stimulus programs have not led to a surge in steel demand in 2021–2022, unlike in Poland, Italy, Germany, Turkey, and a number of other countries. The situation may deteriorate significantly in 2026.

Market profile

Importers are gradually taking over the Romanian steel market amid problems faced by local producers. First and foremost is the Galati steelworks, the only flat steel producer owned by the British company Liberty Steel Group.

The financial difficulties of the parent company GFG Alliance led to months of downtime at the Liberty Galati plant and its bankruptcy (currently in the preliminary stage). A similar situation is observed at other Liberty Steel plants in the Czech Republic, Hungary, Belgium, Luxembourg, and France. The cause of the crisis is not related to the actions of the Romanian authorities.

The metallurgical plant in Hunedoara, a large producer of long products owned by ArcelorMittal, has been experiencing prolonged disruptions. The main factor is the high cost of electricity, which affects the profitability of steel smelting in electric arc furnaces. The other five Romanian electric steel mills, including Ductil Steel, owned by the Romanian company Invest Nikarom, and Donasid Calarasi, owned by the French group Tenaris, are in a similar situation.

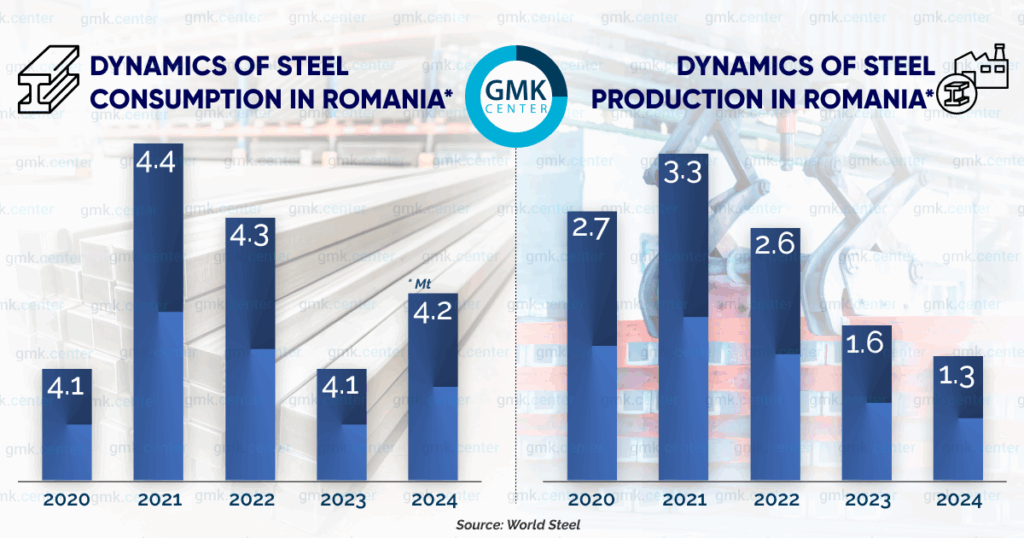

Steel production in Romania has halved over the past few years. Domestic demand for steel products has remained stable, leading to a sharp increase in imports. According to customs data, from September 2024 to September 2025, the monetary value of steel imports increased by 100% – to €3.394 billion. The main suppliers were metallurgical companies from Turkey, Italy, Ukraine, Bulgaria, and Egypt.

Local producers often lose out to foreign competitors, mainly due to high electricity costs. According to SteelOrbis, in 2025, Romanian rebar was offered on the domestic market at €585–590/t FOT, from Egypt at €485–490/t CFR, and from Turkey at €475–490/t CFR.

Demand for flat products

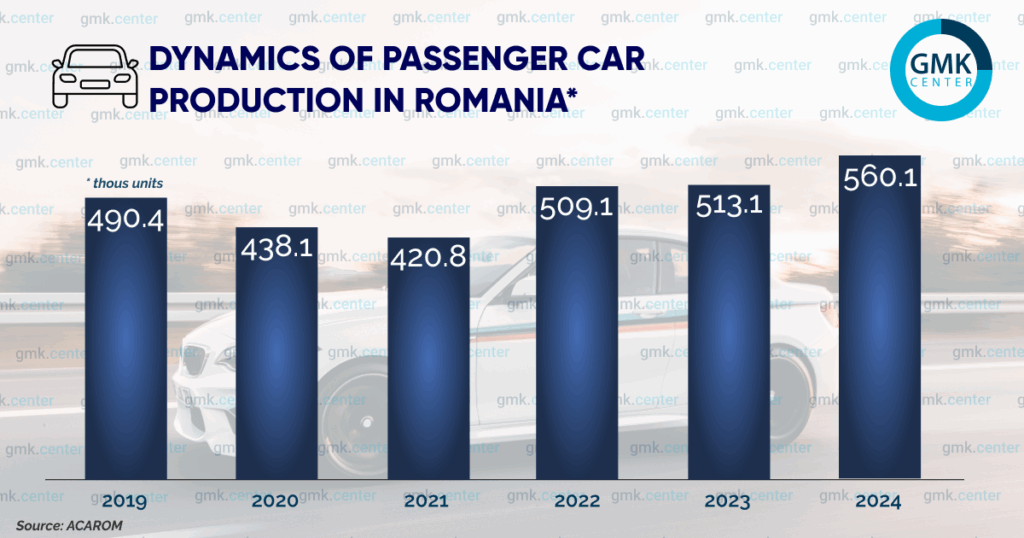

Demand for flat products is driven by the automotive industry, which in Romania is represented by two large enterprises: the Ford Otosan plant in Craiova and Automobile Dacia in Mioveni. The industry has successfully recovered from the COVID shock and set a new production record in 2024.

It was not possible to maintain the positive momentum in 2025. In January–November, passenger car production decreased by 2.48% to 505,859 units. Total car sales in Romania increased again, reaching 156,803 units. This is 3.77% more than in 2024. Truck production in the first half of the year fell by 33% to 6,696 units.

Statistics show the key role of exports for Romanian car manufacturers. The main destinations for foreign sales are Germany, Italy, and France. Demand for flat-rolled products from factories in Craiova and Mioveni depends primarily on the situation in the automotive markets of these countries, which is not improving at present.

Domestic demand remains high, but there are signs that it may weaken. These are related to the sharp curtailment of the long-standing Radla state program, under which the state provides subsidies to car owners when they exchange old cars for new ones. In 2025, the program only began in September. The delay is explained by the government’s policy of reducing spending and minimizing the budget deficit.

In 2024, Radla also operated under restrictions. Initially, €200 million in funding was announced, but in fact, only 30,000 car deals fell under its scope, and in 2025, only 19,000. The Association of Romanian Automobile Manufacturers (ACAROM) claims that the program’s curtailment could lead to the loss of 5,000 jobs in the industry.

The government promises to look into extending Radla in 2026, depending on the budget. Most likely, the program won’t get the same support as before because of Bucharest’s tight budget policy.

The wind energy sector, which has also been stagnant in recent years, has good prospects. At the end of 2024, the total capacity of Romanian wind farms was 3.013 GW, the same as in 2021. No new facilities have been commissioned in three years.

The situation is changing. In December 2024, the European Commission approved €3 billion in funding for Romania to develop wind and solar energy. In 2025, construction began on a 140 MW wind farm in Vaslui and a 190 MW wind farm in Buzău. Danish company Vestas, a leading European manufacturer of wind farm equipment, announced that it had received orders to supply two wind farms in Romania, each with a capacity of 150 MW.

At the end of 2024, Energy Minister Sebastian Burduja announced the government’s plans to increase the share of wind energy in the country’s energy balance to 36% by 2032 (currently 16%). This involves the construction of new wind farms with a total capacity of at least 3 GW.

Demand for long-length rolled products

The current dynamics of the construction industry, the main consumer, look very strong. According to the National Institute of Statistics (INS), in January–October 2025, the volume of work performed increased by 10%. From October 2024 to October 2025, it increased by 4.6%. The indicators improved last year, overcoming the decline, which amounted to 4.9% at the end of 2024.

A detailed analysis reveals worrying signs for steel demand. The growth was mainly driven by capital repairs and reconstruction, which grew by 48.7%, while new construction grew by only 7.8%. Reconstruction projects are less metal-intensive than building facilities from scratch.

The housing sector remains the most problematic. Here, growth was 9.9% after a 21.4% collapse in 2024. It is impossible to talk about a recovery in the housing construction market; the positive dynamics were achieved due to a low base of comparison and the completion of previously started projects. As of July 1, 2025, the number of projects under construction decreased by 5%. There were prerequisites for a deterioration in the final indicators in both 2025 and 2026.

Infrastructure projects, most of which are financed from the EU budget, remain the driving force behind the industry. In 2025, more than 700 km of roads were built, while many commercial and industrial construction projects were frozen. According to consulting firm Cushman & Wakefield, the introduction of new retail and office space amounted to no more than 200,000 m2.

ING Bank’s chief economist for Romania, Valentin Tataru, predicts that activity in the residential sector will remain low in 2026. Mortgage rates will remain at current levels until at least July, putting pressure on demand.

«Developers may postpone or scale back projects until there are clearer signs of lower interest rates, improved consumer spending, or government support,» the expert suggested.

The industrial construction segment will remain stable thanks to foreign direct investment in industrial and logistics facilities. Commercial construction may slow down due to the growing number of vacant spaces in office and shopping centers.

Infrastructure projects financed with the support of the European Union will continue to drive demand for steel in the construction industry. Romania’s own budgetary capacity in 2026 is very limited by strict austerity measures.

Conclusions

The main challenge for steel demand in Romania this year is the tight fiscal policy of the official Bucharest. The projected budget deficit for 2025 will be 8.4%. In 2026, the government aims to reduce it to 6%. To this end:

- From August 1, the standard VAT rate increased from 19% to 21%. This applies to all building materials and cars.

- The previous property tax rates of 5% and 9% have been replaced by a single rate of 11%. A transitional rate of 9% will apply throughout 2026 to dwellings with a usable area of less than 120 m2 and an estimated value of up to €117,900.

- Tax rates on cogeneration (COG) have been increased, which will lead to higher electricity prices for steel producers and, accordingly, their products for consumer industries.

- The minimum income threshold below which personal income tax is not levied has been reduced from €60 to €40.

A significant increase in the tax burden on households will weaken demand for new cars and housing amid the curtailment of government spending stimulus programs such as Radla. Conditions have been created for a decline in production in the automotive and construction sectors, which will lead to a contraction in Romania’s steel market.

The 6.8% increase in the minimum wage to €849.8 from January 1, 2026, will not compensate for the decline in the purchasing power of end consumers.